For Today's Sovereign Individual

Build Wealth in the New Digital Economy

Get the investment thesis:

- The Crypto Capitalist Manifesto

As featured in…

Are You Ready for the Great Monetary Reset?

The world is on the brink of a massive financial shift. The USD and the bonds are dying. The “Great Reset” is not a conspiracy theory; it’s a monetary regime change that will create a new class of winners and losers.

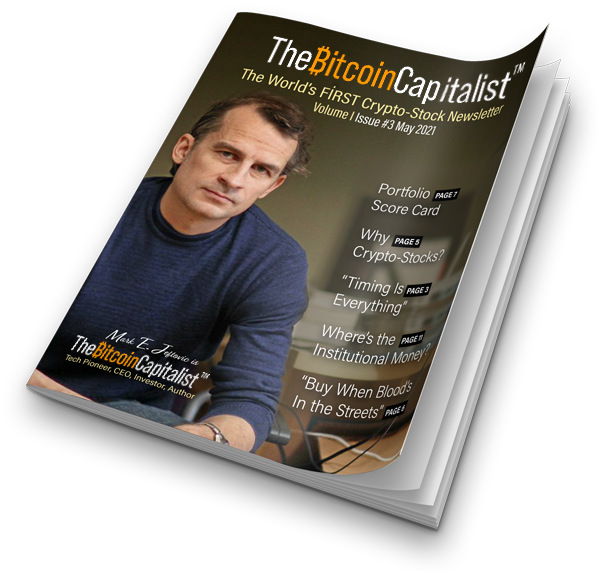

“The Bitcoin Capitalist” is a premium newsletter for investors, high-net-worth individuals, family offices, and capital allocators who want to be on the right side of this change. You will get sound research, analysis, and the conviction you need to thrive in the age of digital assets.

“In the future there will be only one occupation: managing one’s wealth.

…and most people are going to be unemployed.”

~ Mark E. Jeftovic

What is The Bitcoin Capitalist?

We are not another day-trading newsletter. We are long-term, fundamental investors in the future of money. Our core thesis is that we are in the early stages of a global flight from fiat currencies into hard assets like Bitcoin.

Our Approach:

- You don’t get a trading service, you get value-investing. We focus on the long-term, fundamental value of companies in the crypto space.

- You will not get speculation, we are owners. We believe in owning the companies that are building the infrastructure of the new digital economy.

- We provide conviction. In a volatile market, conviction is the most important asset. We provide the in-depth research and analysis you need to have conviction in your investments.

Hi, I’m Mark Jeftovic.

When You Become a Member of The Bitcoin Capitalist

Two Monthly Newsletters

- The Macro-Overview: A deep dive into the financial markets, geopolitical trends, and the battle between decentralized finance and central bank digital currencies (CBDCs).

- The Mid-Month Portfolio Review: A tactical look at our concentrated portfolio of publicly traded Bitcoin and crypto stocks, plus ETF exposure.

Your Bonuses

- Special Reports and Trade Alerts: In-depth analysis of timely topics and immediate alerts on our portfolio moves.

- The Bitcoin Treasury Playbook: Learn how companies are using Bitcoin to protect and grow their wealth, and how you can apply the same principles to your own portfolio.

- The Bitcoin Crash Course: Everything you need to know to get started with Bitcoin, from buying your first satoshi to securing your assets.

- The Crypto Capitalist Manifesto: The foundational document that outlines our entire investment thesis.

- Plus, The Bitcoin Capitalist’s “DEALFLOW”: a Special Bonus for Accredited Investors. Access to deals and private placements that come across my desk. You get a shot major stock gains before prices increase before the public becomes aware.

What Big Names Are Saying

Tyler Durden, ZeroHedge

Charles Hugh Smith, Oftwominds.com

More Profitable Testimonials

“One of the great things about TBC is the occasional special reports on crypto oriented firms like MicroStrategy or on alt-coins like Solana.

Although I had invested in crypto before subscribing to TBC, I was completely missing out on some of the crypto stocks that Mark has analyzed and recommended.

Reading Mark’s analysis prompted me to make some informed investments in ventures that I hadn’t known much about before subscribing.

All but one, (which is only down 6%), of the investments I’ve made based on his advice are in the black and several are up over 50% just in the past few months, and one is up over 200%.”

— Greg L.

“I’ve really enjoyed your newsletter – superb content with a nice dash of humour.

I’ve subscribed to a lot of publications over the years and yours is up there with the very best.”

— Marc S

“I bought 5 contracts of HUT @ $3.48 ($1744) on Sept 6, sold 2 contacts @ $18.48 ($3694) and sold 3 contract today @ $20.46 ($6135).

A great trade.”

— Kevin

Claim Your Copy of the Crypto Capitalist Manifesto

The Everything Bubble Isn't a Bull Market. It's a Currency Collapse in Slow Motion.

Free Manifesto Reveals Why Gold, Silver, and Bitcoin Are Absorbing Capital from the $120 Trillion Bond Exodus

- Position at $50K while others are still debating—then sit back as bond market billions chase you into Bitcoin at $300K+

- Move your wealth before the bail-ins—so you’re not standing in line at the ATM like Cyprus 2013, watching your savings evaporate

- Build a portfolio that survives ANY scenario—whether gold runs first, Bitcoin runs first, or they both 10x together

4243C Dundas St W. Suite 405

Toronto, ON Canada. M8X 1Y3

1-833-755-6263