We have a lot of new subscribers since the last real downdraft, so if this is your first rodeo in terms of crypto-carnage, I just want to put things into a bit of perspective.

First off, the secular bull market in Bitcoin and cryptos is still very much intact.

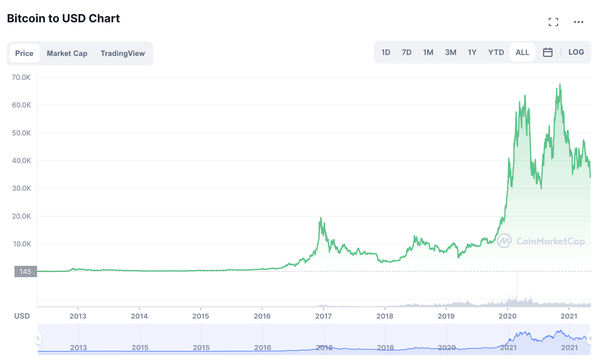

We have been in a counter-cyclical bear market for cryptos since last April, when Bitcoin topped out just north of $61K on the eve of the Coinbase IPO, and we’ve been in a bear market ever since. The subsequent fresh all-time-high to $65K in October (a.k.a “Uptober”) was a false breakout as we entered the endgame for the wider bubble in stocks and bonds.

The Everything Bubble inflated by The Fed and other central banks in the wake of (pick one) The COVID Panic of 2020, The Global Financial Crisis after 2009, the DotCom Bust of 2000 is very much in danger of collapse. Bitcoin is simply being sucked down with it because of the liquidity shocks these events bring.

If you make the mistake of focusing solely on near term Bitcoin chart, those look like some pretty nasty candles down (although the stochastics now look extremely oversold):

However it bears repeating that we don’t put too much stock in technical analysis around here in terms of trying to predict intermediate moves, tops and bottoms. That way lies madness.

The reason why is because Bitcoin is not just another tech stock or company but a new form of money.

Bitcoin has been trading like a “risk-on” asset, and right now we’re in a “risk-off” mode. Bitcoin is caught in the downdraft of wider asset liquidations and forced selling.

When margin calls come, you sell what you can, not what you want.

There’s really only a handful of things that truly matter for determining whether the secular Bitcoin bull market is intact, and those are:

- Are the number of wallets with non-zero balances going up?

- Is the hashrate increasing?

- Is institutional / organization adaptation accelerating?

The answer to all three is yes. That means that the Bitcoin network is still growing, spreading and infiltrating all corners of society. That all then expresses itself in the long term price action:

“Zoom out” is what people who’ve been in this for awhile will tell you, but even a linear chart can still look pretty scary right about now (I’ve heard linear scale be referred to as “panic charts”).

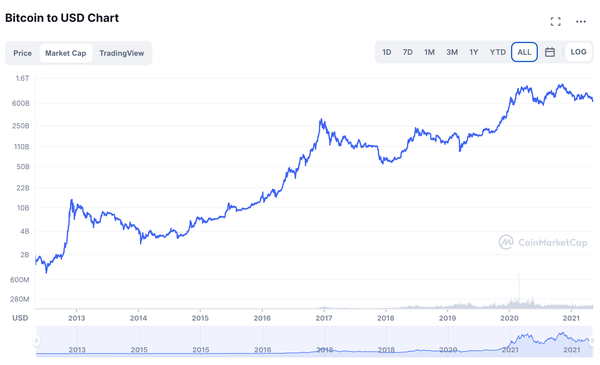

It’s useful to look at the overall trend in logarithmic scale, which smoothes out the spikes. I just care about one thing: what is the overall trajectory and is the trendline intact?

When you look at Bitcoin, we see an unrelenting ascension as more capital moved into Bitcoin since the beginning:

My argument has always been that the majority of this wealth is on a one-way trip. Most of it never intends to come out of the cryptoverse and move back into fiat.

Now let’s compare this picture to something that represents the tech stocks that Bitcoin has recently been correlated with. I like to think of ARKK as The Unicorn Index that underpins the Nasdaq. Let’s take a look at the long term chart of ARKK since its inception, also in the smoothed out logarithmic scale:

The contrast is jarring and we see two very different stories emerging:

The first is a story of a monetary regime change. Central bankers are destroying their own currencies, regardless of this current moment of attempted rate hikes. The current hiking regime will either be remembered as a passing blip on the way to higher money creation, or a cataclysmic policy error leading to the destruction of the bond market.

Either way: capital flees and if only a small fraction of it flees into Bitcoin then it’s a complete game changer.

The latter chart is a visual depiction of a theme that has exhausted itself. It shows us that the Unicorn Economy and The Everything Bubble is running out of gas.

Put both of them together and you have a divergence playing out.

That’s why I think Bitcoin and cryptos are ultimately destined to breakaway from the risk-on assets and take its rightful place amongst anti-fiat safe havens.

Right now the ultimate contrarian play is Bitcoin: This isn’t the time to sell cryptos even if you’re think they are about to break down further. This is actually where we should be stepping into this.

If you don’t any dry powder, then HODL.

If you have dry powder, this is the place to put in another tranche.

If you still haven’t started accumulating actual Bitcoin yet, then start here, start now, start today. Use a dollar cost average like Swan Bitcoin, or open an exchange account (Canadians: BitBuy, US: Coinbase, everybody else Kraken).

Nobody can tell you how much more this will go lower or when it will end. But I will tell you this, after this crypto bear is over, we’ll never see these entries again.

The mid-month portfolio letter should be out in a week.